Integrity in Africa

5th Viadrina Conference – Panel 5 – Compliance in and for Africa – 5th July, 2017

5th Viadrina Conference – Panel 5 – Compliance in and for Africa – 5th July, 2017

Africa – an often forgotten continent, far too over looked when it comes to international influence within a socio-political and economic setting, yet this is a continent that consists of 54 countries (just under a quarter of the worlds recognised countries by the UN), a contributor to 3% of world GDP, a region that holds 72% of the world’s core natural mineral resources (Bauxite, Cobalt, Gold, Diamonds, Uranium, Copper, Platinum etc), an estimated 1.2 billion in terms of population, but ironically a disappointing Foreign Direct Investment (FDI) index estimated at less than 1% – an unimpressive statistic by any standard and yet this continent of some 11.7m square miles with all its natural resources, human resource talent and huge potential for growth and investment is home to some of the most impoverished citizens on earth by western standards who get through life on less than a dollar a day. It doesn’t take a rocket scientist to tell you – something is very wrong here.

The total annual combined revenue of Africa’s 5 poorest countries does not come close to the wealth of today’s world’s richest man – Bill Gates1. Yet seven centuries ago, the richest person in history (even by today’s index linked standards) with an estimated wealth of $400 billion was an African named King Mansa Musa of Mali2.Ironic isn’t it or is it just me! So what is the cause, why is the African continent in this timeline and how does it find itself in this predicament?

The information above does give you an idea of the problem and the imbalance but to appreciate the context and deduce where the fault line occurs, we must separate “perception from reality”. Take a look at any satellite photos of the world from space and see the countries and continents lit up at night. Without any doubt, the African continent is the least lit. From a “save the planet” perspective, this perception is ever greener, and with good ecological credentials, but if we view this from an economic reality, growth & development standpoint, it shows just how development in infrastructure, energy and resource is weak, slow and lacking in most countries within the said continent. Several factors account for this but the common denominators that do stand out are corruption, lack of good governance, poor leadership and planning. The rest of the world sees this as a problem that hinders businesses, I on the other hand see Africa from a different perspective – one of vast untapped resources, opportunity and a people that want change and are slowly getting there – like a skilled impressionist painter with a blank canvas, it takes several strokes of the brush and paint, time and patience to produce a master piece.

This article will address the above context on the following five (5) core questions based on some of my submissions made at the G20 inspired Viadrina Compliance Conference in Hamburg on July, 20173. The areas of my focus based on questions discussed on Day 2 will be as follows:

The great German Philosopher, Friedrick Neitzsche once said “…from chaos, comes order…” This quote exemplifies the perception of the “African factor” in today’s world. An often criticised world thought to be behind times, corrupt, difficult to do business with and in order to fit in you will have to give into corruption – a phrase often used is TIF – “This Is Africa”. For those who remember the Hollywood blockbuster – Blood Diamonds with Leonardo DiCaprio, you will know where I am coming from4. But is it always this gloomy as the world will have us to believe, or should we as investors be braver, more supportive and envisage a long term plan in our business strategy?

Let us now see how business opportunities do exist in a world which most of us perceive as chaotic and a region too difficult to do business in. But first let’s discuss the extent to which corruption has affected Africa.

To do justice to my submission, I must emphasize a hidden notion that is very often overlooked and far too judgemental and that is bribery & corruption exists worldwide in all sizes, shapes and forms and within different societal structures. It is far too often stigmatised and blamed as the cause of Africa’s problems. Whilst I do acknowledge some of this blame is true; having lived in Nigeria for over 29 years of my life, it is not the only problem and Africans are not the only problem. The embodiment of corruption is a notion that is relative from society to society. In some regions of the world; and indeed in Africa, it is an “in your face” experience, in other parts of the world it is below the radar, hidden and packaged in a sophisticated format; much can be said of case studies in the West and developed worlds.

Corruption in Africa, is endemic and in some countries has become the very fabric and foundation of society, not as a matter of choice but as a consequence of survival. That very survival instinct gives an individual or entity two choices – either accept the trend and live up to the adage that says – “if you can’t beat them, join them” or the second noble option would be to do the honourable thing and refuse to be corrupted and move elsewhere – the latter is easier said than done.

If a society has the means of production, human resource, infrastructure, energy, market demand, a stable economy with the very basic of social amenities in good working condition, good governance and leadership, why would we have the levels of corruption as we do today, why would the average migrant risk their lives to cross the Mediterranean into Europe. They do so because they choose to live. Growth, development, good governance, creation of jobs, reduced unemployment and a strong and positive socio-political and economic setting in my opinion reduces exposure to the need to rely on charity supports, ill-vices such as bribery & corruption or the need to flee for greener pastures which is what we see in today’s European migration pandemic.

Let’s pause and look at the actual causes of corruption with two simple real life case studies. Consider this for a moment – Africa’s wealthiest country and largest oil producing nation; Nigeria, has been estimated to have had over $400 billion embezzled through corruption since its independence in 1960 much of which has been siphoned out of the country and invested overseas or in financial institutions. This is an appalling ideology and abuse of trust and office by those who have perpetrated this act over decades but like the saying goes – it takes two to tango – and this is where I beg to differ when the continent is stigmatised with the notion of corruption. Have a look at the following case studies in response to my notion.

The United Nations has estimated that by 2050, more than half of the world’s population will come from Africa5. Today, Africa has by far the world’s youngest population with an average age of 25 years. This is a promising feature when it comes to market economy, consumer growth, man power, urbanisation and opportunities for investors and with Africa’s economic growth accelerating in the early part of the 21st century making it the world’s third fastest economic region (as noted in the diagram below)6, the world has started to think twice about the opportunities in this forgotten region.

Exhibit 1:

What Africa needs today is not aid, charity or pity but good old investment and strong partnership from foreign investors. Africa also has a part to play by looking within itself and collectively build the desire and will to change and the realisation that in order to progress and catch up with the rest of the world it needs to tackle corruption head on, build its fallen infrastructure, improve on security, and foster good governance through exemplary leadership. Investors need confidence and trust and Africa needs partnership in exploiting its vast opportunities – genuine partnership and not selfish greed and exploitation.

To achieve this it must learn to guarantee security in investment and dispel the insecurities which the world unfortunately knows Africa for. When you look back at dictatorial regimes such as that of the late Idi Amin Dada of Uganda, Mobutu Sese Seko of former Zaire, General Sani Abacha of Nigeria, Omar Bongo of Gabon and of recent President Robert Mugabe of Zimbabwe you realise a trend and mentality, but that era is slowly but surely changing with Africa having the youngest population boom in our generation.

Foreign investors also have a role to play by collectively learning to say “no” when it comes to lucrative contracts and opportunities. What breeds corruption at a massive scale is the willingness some foreign companies and government tend to go in order to secure deals by any means necessary. Zero tolerance should mean just that and be seen as a means to doing the right thing and “collectively agreeing to stick to ethical principles”. The break in the chain is the only reason why corruption is rampant and all in the falsehood of the notion that – “this is how business is done in Africa” and my answer to that is no – Africa is not all about corruption and change needs to come from both ends.

Think about this for a second – if an African high tech sector such as in “renewable energy” secures bids from 5 top foreign companies and all five have the same common goal to compete in order to win the bid and ironically respect the ethical codes of conduct in doing business and no one passes a “brown envelope” to leadership or interested parties within the African caucus who are in a position to influence the winning bid, would there be an incentive to bribe if none of the companies agree to do so in the first place? I think not.

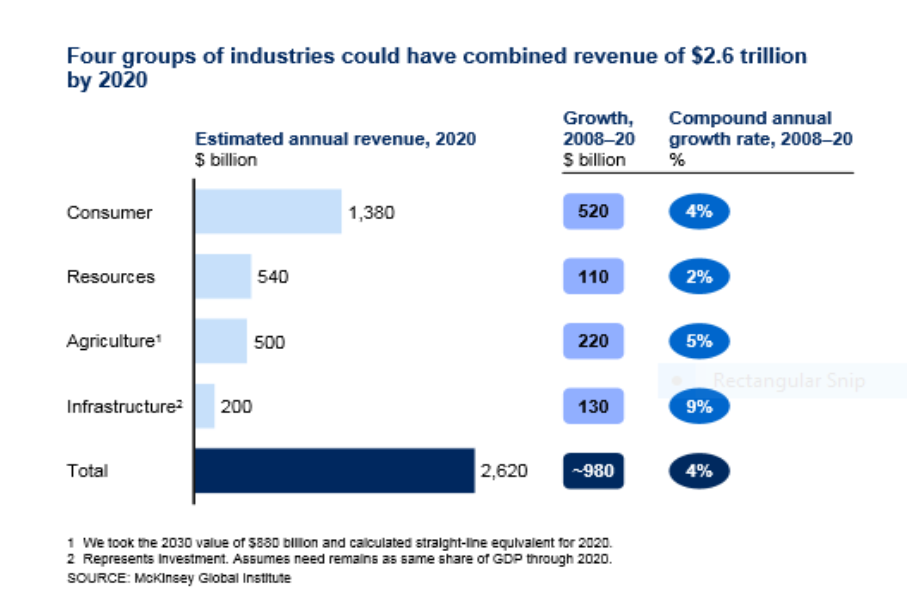

Africa has huge untapped potential and its consumer market opportunities have been projected to be in the region of $1.4 trillion by 2020. The McKinsey Global Institute has done an analytical survey of several sectors in Africa and have confidently submitted that four groups of industries in Africa could generate some $2.6 trillion in annual revenue by 2020. These four groups are mentioned below and are our focus on why I feel may be part of the trigger and catalyst to winning investments into the region. The industries/sectors are:

The diagram below7 shows McKinsey’s analysis of how four industry sectors in Africa could by 2020 have a combined revenue stream of over $2.6 billion. This is a positive drive for investors who can see the potential for return on investment.

Exhibit 2:

In the interest of time, I will focus on only two of the four sectors for my submission.

Agriculture:

Africa has some of the fertile soils in the planet and yet 60% of the world’s arable land mass that has remained uncultivated comes from Africa8. This is an astonishingly surprising and disappointing statistic coming from a region that has suffered some horrendous famine over the past 3 decades and yet positively thinking, it is a massive opportunity that is untapped, under developed and an avenue for massive foreign investments. The potentials from the sale of cash crops and the increase in demand for upstream products such as fertilizers, seeds, pesticides and machinery would make the region and sector highly sought after thereby positively changing the dynamics to growth and development.

The current downsides why this hasn’t materialised could be the red tape bureaucracy and unfavourable policies but countries in Africa are slowly but surely opening up as they learn to take advantage of the Brazilian model where back in the 1980’s millions of hectares of land where brought back into cultivation and with government support and FDI (Foreign Direct Investment), Brazil became one of the largest producers of Beef9.

The diagram below10 gives us an idea of the amount of available cropland within Africa that is currently untapped and open for business opportunities.

Exhibit 3:

Infrastructure:

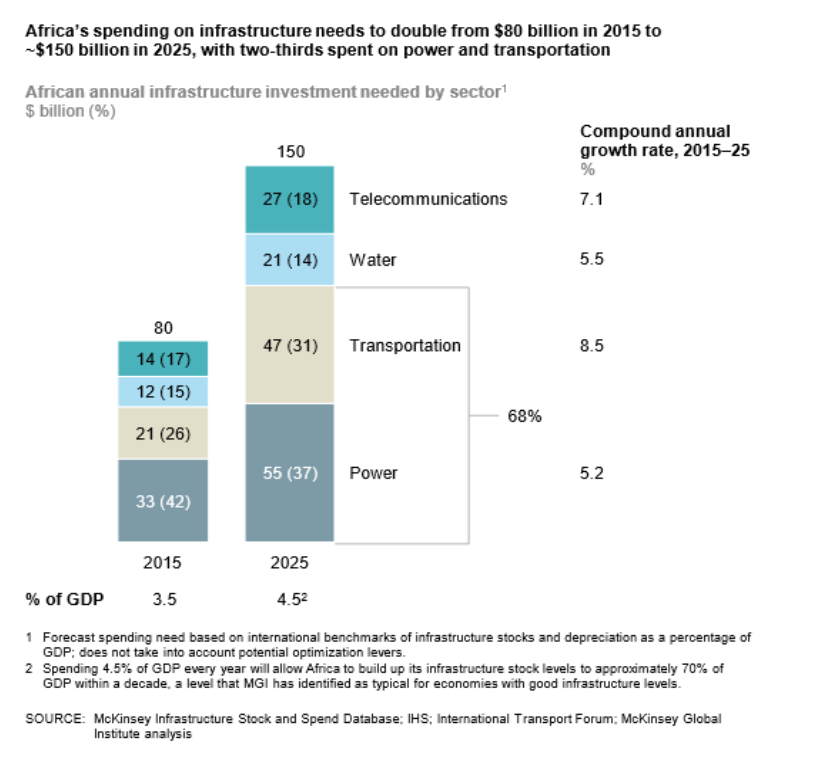

Ask any educated or none educated African in the streets of his or her country and one key area they can whole heartedly tell you is lagging behind is “investments in infrastructure”. Unfortunately, Africa does have a problem of “maintenance culture” – I know it first hand, as I was born there and have lived there for 29 years of my life! This is especially true within public sector utilities such as electricity, water, tele-communication, postal services, transportation (road, rail, airlines services) etc.

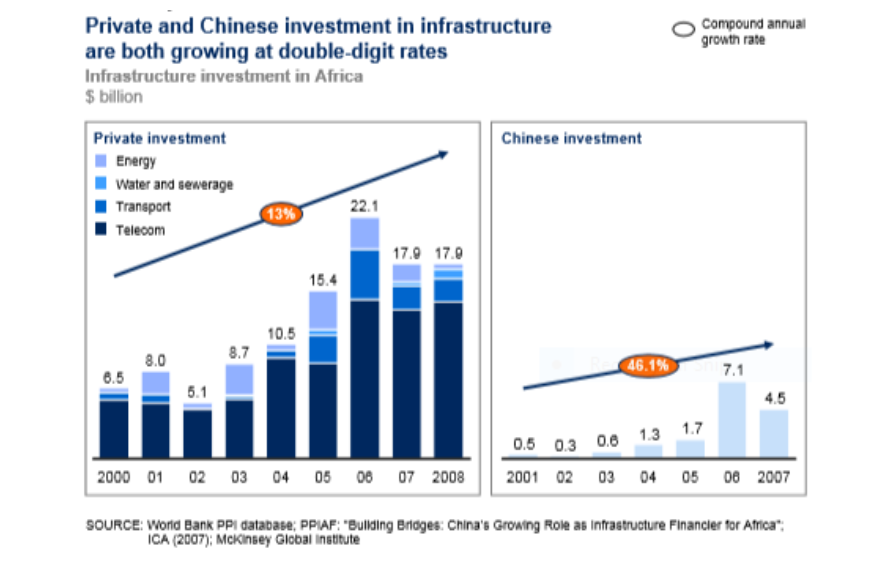

The nationalisation of these services, increase in “ghost workers” (illegal over employment), poor management, inadequate maintenance, poor bill collection practices etc have destroyed the very existence of this once lucrative industry and therefore discouraged the much needed investment and interest from the private sector. This submission justifies the sentiments shared by experts where it has been analysed that for Africa to compete, it needs to at least double its current investment spend in infrastructural improvements. The diagram below11 justifies this supposition.

Exhibit 4:

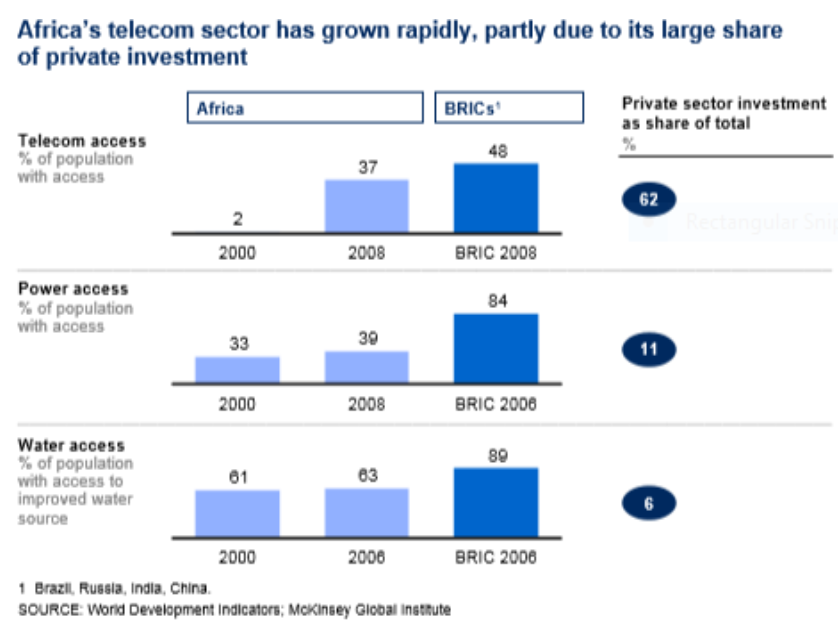

The revolution of the mobile industry and its massive success; where there are over 1 billion active subscribers of mobile phone12 has revitalised the banking industry where mobile banking and the telecom industries have become a phenomenal success. Africa today boasts some the most secure online banking technology platforms – a well-known factor which even friends of mine who come to the UK shun the archaic technology we currently have in our banking system.

This sector has drawn foreign and private investment towards building the much needed infrastructure that has sparked this African success story. Take a look at the diagram below which shows how Africa has come from 2000 – 2008 when the boom in mobile telecoms started13.

A comparison of the rise in telecom over other utilities and against BRIC nations shows just how huge infrastructural investment is important. It also gives empirical evidence of what could very well happen if FDI, Government and Private Investors turn their gaze to infrastructural investments in other utility sectors.

Exhibit 5:

China has realised that it too can capitalise in benefitting from both its import strategy of raw materials from Africa but also investing towards the improvement of the dilapidated infrastructure in some African countries which is the lifeline to getting the economy moving, creating jobs and triggering growth and development. China has also realised that if you build a strong long term strategic plan and support the growth plans of infrastructural regeneration, the leadership and governments in the regions will back contracts that use Chinese, products, Chinese technological & knowhow and long term maintenance contracts – a very lucrative deal.

The downside and reality however is that China tends to use its own labour force which stifles the amount of foreign currency and earning capacity that an average African would or should have. The Western civilised economies need to learn from this and devise a “win-win” formula to gain the trust and shift in dynamics if they are to succeed in the battle for African investments and opportunities. The graph below shows just how China is winning the game in Africa with evidence of “double digit growth” as their role and influence grows in becoming Africa’s single largest infrastructure financier14.

Exhibit 6:

I often get asked this question and I also often answer the question with a question. So my response is, do we want to know the truth or do we want a political answer? I will give both in this article.

First the political answer –

Africa is going through a change at the moment and with that change comes the realisation that in order to attract Foreign Investment it needs to come to par levels with Western civilisation, legal and regulatory framework of which compliance in regulations such as AML (Anti-Money Laundering), ABC (Anti-Bribery & Corruption), respect for Human Rights, economic versatility, freedom, ease of doing business and respect for copyright and good corporate governance practices are some of the core foundations towards getting the recognition and respect it deserves from the rest of the World in terms of market opportunities and the potential for growth and development.

Now the truth –

The truth however and reality on ground is somewhat similar but with a slight twist. This slight variance in opinion comes from those African countries who take socio-political and economic change as part of the core pillars to a sustained plan of growth and development as opposed to those nation who cling onto a stagnant policy of control by a few, economic depression and naivety and failed policies which starve the existence of several societal services which a lot of us in the western civilised world far too often take for granted i.e. healthcare, education, security, economic prosperity and the rule of law.

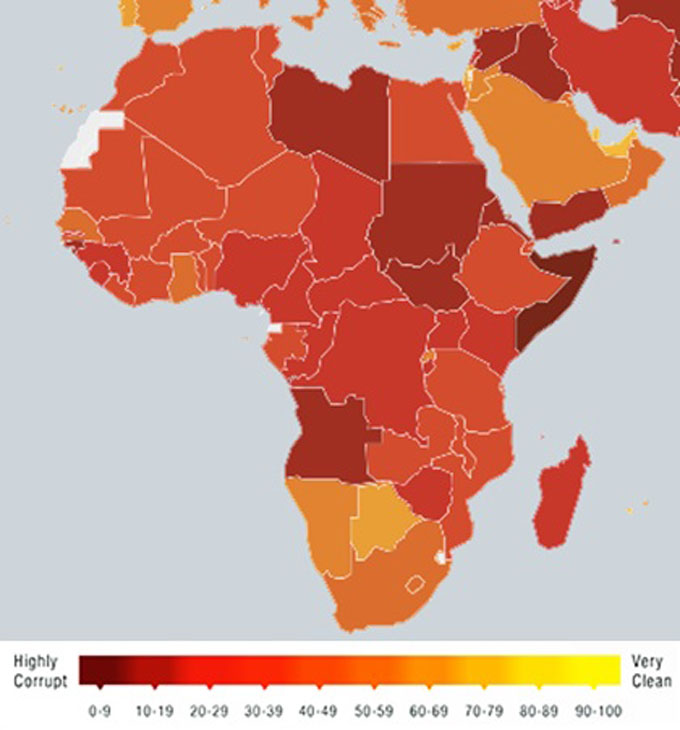

The Transparency International’s Corruption Perception Index (TI-CPI) is a good starting point towards understanding the state of progression; or regression in compliance; particularly in the area of corruption. It appears progression in compliance can be safely said to equate with progression in economic growth if we factor in the level of growth and development fuelled through foreign trade. Foreign investors gauge confidence and trust as the pinnacle to a sustained partnership of success and the litmus test to this is in a country’s governmental fiscal policy and regulatory framework – simply put, how easy and safe an environment is it to do business in and how secure is my investment and return? Stability in compliance & regulation is one pillar to this theory and Africa is definitely getting there in my view.

If we look at the progression of a few known countries in Africa from 2000 to date, we can see how progress in compliance has in fact shifted from a “non-existent” status to a “realisation platform”. Compliance has indeed taken centre stage but in today’s Africa this is more of an “evolution rather than a revolution”. It is going to take some time before Africa gets to the levels of the so called 1st world countries and in my view, part of the main catalyst and driver for this change is through “compliance” and the growth of “private sector” investment.

The realisation of investment opportunities, revitalisation of what was once state owned projects and development programmes has in some sectors fuelled consumer growth, improved creation of jobs and opportunities in the private sector. Corporate existence and the need for good governance and proactive regulations that favour business is seeing a gradual shift in the way business is done in Africa. Although it is slow; I must admit, but it is there and happening – besides Rome wasn’t built in a day. So how, does the private sector change the spectrum of compliance?

Let’s take the Dangote Group of Companies in Nigeria as an example – this is a local private structure investment vehicle owned predominantly by Africa’s richest man; Alhaji Aliko Dangote. Known already for his “consumer goods” sector and his cement factory (one of the largest in the world), his company’s current petro chemical infrastructural investment in the outskirts of Lagos Nigeria within the Lekki Free Trade Zone region is a $12 billion investment with a potential to create over 60,000 jobs in the region and diversify Nigeria’s economy. The refinery, once finished, would be one of the world’s largest single pipeline refinery capable of producing 650,000 bpd15.

This has been a sector run by the Nigerian government for over 4 decades. It is tarnished by the decadence of corruption with a known history of having none of its 4 oil refineries ever working at full capacity. The combined output of all 4 refineries when they do work is estimated at just 400,000bpd – well below the single refinery currently being built through private investment.

The oil industry sector is the source to “black market” inflation, scarcity of fuel and importation of crude oil derivatives. For a country known as the world’s 13th largest producer of crude oil16, this is a sector that surely discourages foreign investment because the outcomes mentioned above epitomises the lack of trust and confidence needed by investors to build, grow and improve on sustainability, efficiency and productivity. But then again, it is a sector filled with opportunities, consumer demand and little per capita investment from the private sector. It has mainly been public and state funded.

The Dangote refineries once built is destined, or should I say “targeted and driven” to solving a problem that I have known existed since the early 70’s when I was born – This is the power and potential of “private sector investment” fuelled by both local and FD investments. The success of this programme will in my view put pressure on the public sector and government who will have no choice but to embrace change and straighten their act over time. The demand and need for consumer change is there and this shift in strategy and concentration of investment opportunity is where Africa is seeing the greatest change. Governments will have to swallow the bitter pill and realise that in order to attract FDI, it would have to address several ill-vices of which corruption and improvements to regulatory reform (implementation) and the rule of law are top on the agenda.

Too far-fetched and wishful thinking I hear you say, then take a look at these statistics as to why change will in my view become eminent in this continent.

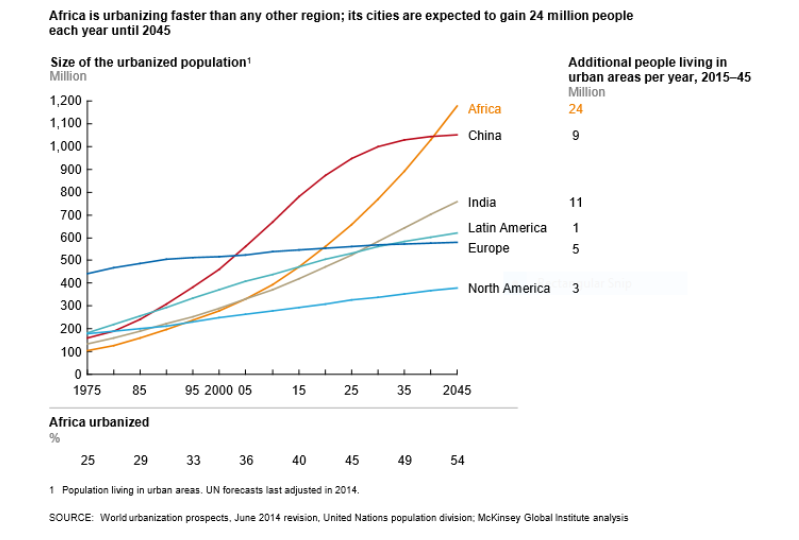

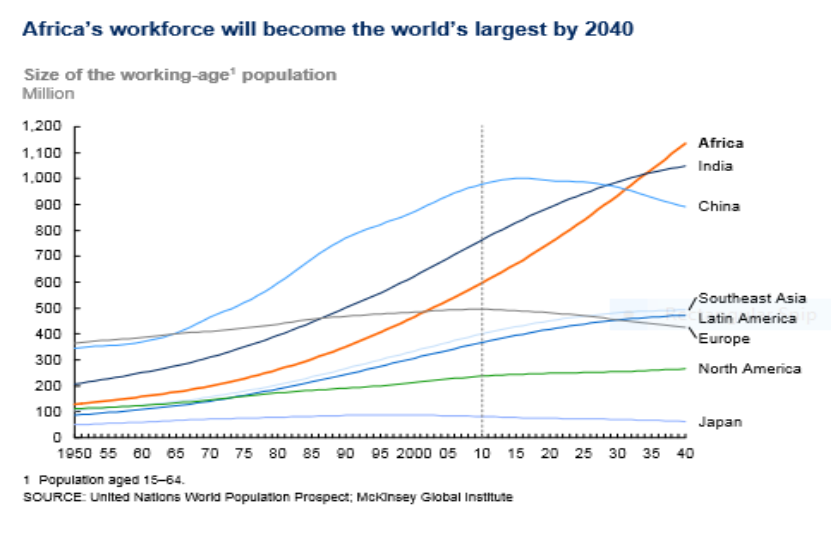

By 2020, the McKinsey Global Institute estimates that Africa’s collective GDP will hit $2.6 trillion, its consumer spending is estimated to be $1.4 trillion with the number of African’s of working age expected to hit 1.1 billion by 2040. The population growth and age demographics of those within working age is set at between 18-35 year olds. It doesn’t take a genius to see the growth in urbanisation with an estimated 50% living in cities by 2030 or the number of new subscribers to mobile phones which in the year 2000 was at 316 million subscribers and estimated to reach 700 million by 2020. There are opportunities in the African continent compared to the rest of the world (even Asia) as the graph below (showing urbanisation shift)17shows as well as further submissions within this article suggests.

Exhibit 7:

Still not convinced? Well I can understand why and even though African countries have seen record promulgation of laws, rules and regulations in the field of compliance within the last decade, the problem comes from not just recognising these compliance issues but actually implementing the much needed regulatory changes.

Some African countries are just not there yet when it comes to comparing the state of development to that of the west / developed countries. However, my position and view is that we shouldn’t be comparing Africa’s level of change to that of the western civilised regions, rather we should be encouraging change in a continent that is embarrassing change however slowly.

So what countries have made these changes and can now be seen as potentials for investment? Let’s take a closer look at this.

This is a difficult one. Africa consists of 54 countries each with its cultural, economic, legal and societal differences. The issue at hand is on a selection of African countries who fit the bill when it comes to “integrity” within compliance. This can be achieved by assessing six (6) reasonably reliable governance indices from a reliable report published by the African Corporate Governance Network (ACGN) in an article entitled “State of Corporate Governance in Africa – An overview of 13 Countries”.18 The countries are:

The surveys used to assessing overall integrity in compliance are as follows:

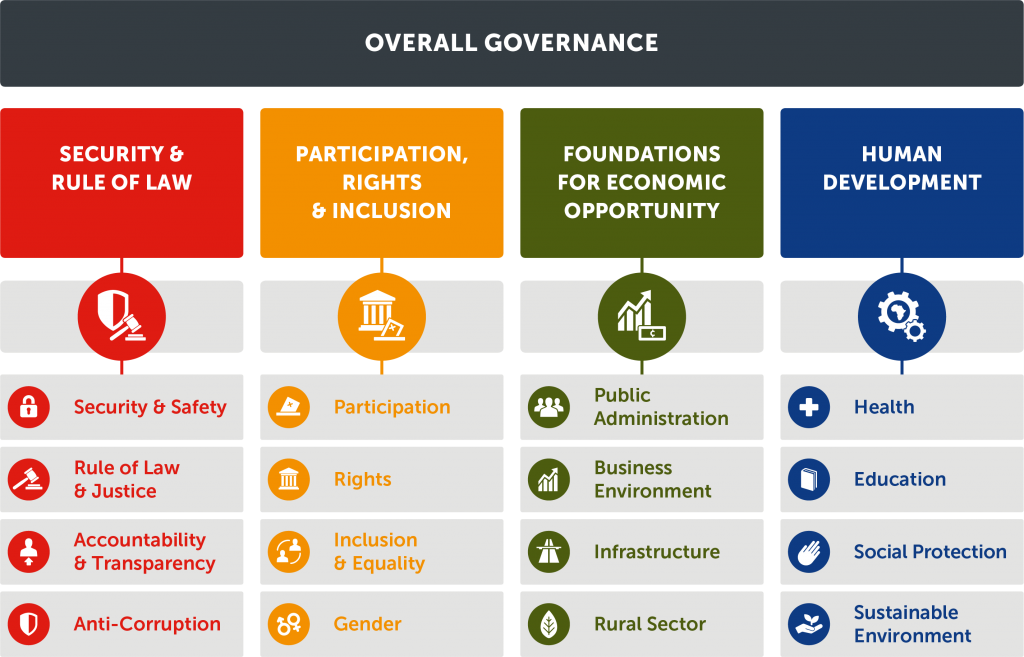

(a) The Ibrahim Index of African Governance – This is a an index set up by one of Africa’s Billionaires named Mo Ibrahim through the Mo Ibrahim Foundation which caliberates and measures the quality of governance in 54 African countries accross 4 categories of governance performance indicators – these include safety & the rule of law, participation & human rights, sustainable economic opportunity and human development.

(b) The Index of Economic Freedom – This is an index created and managed by the Heritage Foundation and it ranks 186 countries worlwide to determine the level of economic freedom in society through its tracker of 10 factors of economic freedom grouped into four broad categories which are: rule of law, limited governments, regulatory efficiency and open markets.

(c) The Corruption Perception Index – This is an index by Transparency Internation which measures and scores the level of corruption perceived in 168 countries around the world. The CPI index indicates the perceived level for public sector corruption on a scale of 0 (highly corrupt) to 100(least corrupt). In the diagram below, the index looks at a ranking based on 168 countries and the position of countries within determines how corrupt they are. For example: Tanzania in 2015-16 was ranked 117th/168 and Mauritus was ranked 47th/168 making Mauritus a much more cleaner country as far as corruption is concerned.

(d) Global Competitiveness Index – This is an index created and managed by the World Economic Forum and it contains an annual assessment of the factors that drive productivity and prosperity in over 140 countries worldwide.

(e) Ease of Doing Business Index – This is an index created and managed by the World Bank which provides an objective avenue aimed at measuring business regulations and its enforcement accross 189 countries / economies.

(f) Economist Intelligence Unit, Business Environment Rankings – This is an index that assesses the attractiveness of the investment climate accross 82 countries of the world.

Exhibit 8:

From the above chart, what can we summarize?

I will discuss the outcome and summarize my views on two of these indexes – the CPI Index by Transparency International measuring the level of corruption in the public sector and the Ease of Doing Business Index by the World Bank which looks at the objective measures of business regulation and freedom.

From the survey, it is quite clear that the cleanest country as far as corruption is concerned within the selected top African countries for governance and investment is by far Mauritius. With a score of 47th from the TPI index (now 50th from the 2016 index), this is pretty decent in a continent where 90% (50 out of 54) countries are considered “very high risk” in the world of compliance. The cleanest top 5 African countries; as far as corruption is concerned in Africa today based on the recent 2016 CPI index survey are the likes of Botswana (35th), Cape Verde (38th), Mauritius (50th), Rwanda (51st) and Namibia (53rd). Let’s give this a bit more context and perspective to the reader.

In Europe and the rest of the world, as far as corruption is concerned, the CPI rankings puts Denmark, New Zealand and Finland as the top 3 least corrupt countries in the world (in fact most Scandinavian countries are amongst the least corrupt countries in the world and have historical maintained that position) – do they know something we don’t and can we learn from them?.

Now here is the surprise element – United Kingdom is ranked 10th cleanest; tied in with Germany, United States of America is 18th, Spain is 41st, Italy is 60th, China & India are tied as 79th, Argentina is 85th, Russia is 131st and Nigeria is 136th.20 You now be the judge of the outcome. Corruption exist everywhere in the world and in different doses and forms and how we determine which country is more corrupt is in my view a sensitive, surreal and subjective ideology.

If we consider the fact and supposition that for corruption; and especially bribery to thrive, it must have either the “active and passive” forms of giving and receiving or the commission of an act for the undue and illegal benefit of another. If we look down on African countries then we in the west need to take part responsibility for receiving the hundreds of billions of dollars embezzled over decades in the private banks and tax haven jurisdictions – should that not then correspond with the rankings of some alleged clean countries – I think it should. The likes of Switzerland, the United Kingdom, France and the USA need to do more to partner with these African countries rather than point the finger of blame.

On the next index – the Ease of Doing Business, again Mauritius tops the list. This index gives a sense of comfort, security and reassurance most investors need when it comes to investing. Most other African nations in our list of 13 don’t do as well – I guess this is room for improvement and one that must be tackled through regulatory reform and flexibility in economic and fiscal policies.

So, if asked again, what countries in Africa do I see as making progress or as champions that have made progress in the field of integrity and compliance I would say with reserved caution these would be the likes of Botswana, Namibia, Rwanda, Ghana, South Africa, Mauritius, Kenya and not surprisingly Nigeria. Although the stats suggest that the average top 5 problematic factors for doing business in these countries in Africa are access to finance, corruption, inadequate supply of infrastructure, tax rates and inefficient government bureaucracy/policy instability, I submit that the share size of some of these nations and changing the mind set and leadership mentality in government are factors hindering immediate change. That said, positive change driven by the outlook of a younger, more educated and aware generation will spark the huge drive in economic growth.

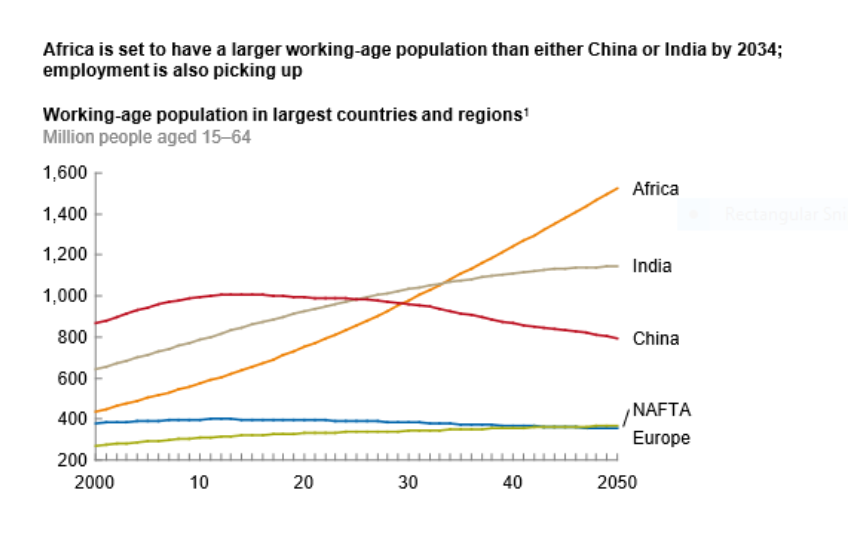

Just take a look at the graphs below which forecasts that by 2040, Africa will have the world’s largest workforce and working age population surpassing both India and China.21

Exhibit 9:

Now is the time for the rest of the world to heed change and opportunity in a continent that is opening its doors to economic, regulatory reform and diversification, slowly but surely.

Africa’s economy is growing rapidly as governments realise that lowering inflation, trimming foreign debt and reducing their budget deficits paves the way to a brighter future; if managed properly and consistently by their governments.

Countries such as Ethiopia, Nigeria, Botswana and Namibia are realising that energizing their markets through adopting creative and favourable policies, reducing trade barriers, cutting corporate taxes and strengthening regulatory and legal systems paves the way for foreign investment; particularly in the field of private equity investment. There is no disputing that the ROI (Return On Investments) in Africa is huge, it’s the confidence and security issue that worries investors and what ironically worries Africans is the realisation that some investors are only interested in the “bottom line” and what they can get out of Africa. Yes, the region has problems of corruption, yes, it is difficult to do business in most of its countries but it all starts with business, governments and investors taking chances, building strong and positive strategic partnership with the right people, the right country and for the right reasons – not just selfish gain.

China succeeds today in Africa because it realises that to gain the trust in the region it needs to invest in the community. Don’t get me wrong, there are problems and case studies of connivance in corruption, sub-standard practices but the general notion is that China today has done more for Africa than most other investor nations – at least that’s what we are made to believe.

Success in Africa does not mean giving into corruption. It means being a partner towards embracing meaningful change. Investors can only succeed in Africa if they do the following:

Be it through foreign ogovernmental investors or private equity investors, the key to success in Africa is securing advise from the real McCoy – local trustworthy consultants, advisors, business partners who know the region well, have lived, worked and uderstand the in’s and out’s of society rather than what I would call the usual suspects who have no clue about African culture, history or way of life.

The typical African mentality of respect for their elders is a principle engrained and enshrined in the DNA of every true African and in every society. A business allegiance with a trustworthy power broker that commands respect and obeys the rule of law is often seen as a positive strategic plan for success in both medium to large scale investement opportunities. It often is seen as a seal of approval and the much needed protection in an environment that is going through rapid change but still holds back to old customs and practices – it is an insurance policy of success and security if you are smart in selecting the right mentor.

contrary to popular belief that Africa is synonymous with corruption, quite the contrary is the reality from those who truly know Africa. The continent values honesty, integrity and the truth. The very supression of the truth and corruption in public sectors does not take away the common good of the community who want to prosper. The EU Water projects in Sub Saharan Africa is a key example of this where society distrusts the state and public officials but are willing to work with private investors if they keep to the promise of developement and job creation.

This isnt an arrogant ideology but one of embrassing the many untapped opportunities that exists in Africa today. Take the energy sector for example. Africa is a region that needs massive investments in improving avenues for growth and development in every known sector i.e. manufacturing, consumer, resources, agricultural and infrastructure sectors and industries. All these areas require energy – raw energy. Opportunities in renewables, electricty, gas are huge and untapped.

The Niger Delta crisis in Nigeria is a constant remind of how not to milk a nation of its resources and let the communities from which the wealth in oil is extracted from suffer in abject poverty. A back and forth blame culture exists in this mess but the reality is if you invest in your host community, you not only improve theor standard of living, growth & development, but you secure your company’s investment, secuirty and future through their trust, respect and admiration of the community. Indirectly, by practicing good corporate governance and maintaining constructive corporate social responsibility, you have hired public security for life!

Africa is here to stay and the future looks bright. Investors should thread with caution but open their minds to what currently is a blank canvas filled with opportunities for change, reinvention and continuity. Private equity investment and infusion of investment through the private sector; in my opinion, is key to the success in Africa – the public sector will realise its mistakes and open up eventually. Investors need to do their homework and align their thoughts and business acumen with the right consultants. They need to understand their market, respect the host nation’s cultural and religious setting and partner up with people who know the country first hand and not with business partners, consultants or advisors who claim to know the environment from their office desk thousands of miles away with no clue of the dynamics of the society in Africa which is different and ever changing.

Corruption is a hindrance but businesses still thrive in the region and there are legitimate ways of making money in Africa and avoiding being the pawn of corruption. Africa has a bright future of innovation, prosperity and global relevance. Let us invest in her to see that she achieves this goal.

See CNN News Publication – Inside Africa – Entitled “Africa’s Richest Man is Building an Oil Refinery” – Aired in 2016 and video found at this online link: http://edition.cnn.com/videos/cnnmoney/2016/06/06/nigeria-dangote-oil-refinery.cnn